It is common for small business owners to analyze their financials after the fact, such as during tax season, while applying for a loan, or when an issue occurs. But the actual power of financial data comes from exploiting it as a strategic asset, not just keeping track of it. When you use your numbers well, they may help you make decisions and build a wiser, more sustainable small business growth plan.

Watching your profit and loss account is not the same as doing actual small business data analysis. While the latter helps you grasp what’s driving the figures and where the opportunities lie, the former only provides you with a glimpse. That difference is quite important, especially if you want to grow, minimize costs, expand, or make more money.

Make sure that your business plan and your financial analysis are in sync. Numbers without context are just noise. By connecting your financial picture to your goals, you make a document that changes as your plan does.

Step 1: Define Clear Business Objectives

Make sure your objectives are clear before looking at any spreadsheets. Do you want to raise your sales at the top? Lower operating costs? Do you want to expand into a new market? What you look at in your analysis will depend on what you want to learn.

For instance, a small store might want to boost its gross margin by 10% over the next two quarters. Before launching a new product, a service-based business would seek to cut its operating costs by 5%. These goals have a direct effect on the financial measures you should be looking at.

It is also very important to connect your financial assessment to your small business growth Plan. When your organization is first getting started, you may be more concerned with cash flow and customer acquisition. As you grow, you may focus more on improving margins and operating efficiency. Knowing what stage your firm is in lets you make your financial assessment not just useful but also strategic.

Step 2: Gather and Organize Relevant Small Business Data

The first step in data analysis is gathering accurate data. Pay attention to the financial documents that are most important, such as income statements, balance sheets, cash flow statements, and sales reports with lots of details. Depending on what kind of business you have, you also need to keep track of your inventory and payroll.

Reporting must be consistent. Whether you look at small business data once a month or once a quarter, make sure the intervals stay the same.

To facilitate this process, the majority of spreadsheet and accounting software packages include basic templates. The purpose isn’t to collect data for the sake of collecting data; it’s to get clean, full, and accurate records that can help you learn anything useful.

Step 3: Track and Analyze Cash Flow Patterns

One of the easiest methods for small businesses to see if they are doing well financially is effective cash flow management for small businesses. Simply having funds in the bank is insufficient; you also need to understand how, when, and why money enters and exits your company.

Inefficiencies could be hidden by positive cash flow if surplus funds aren’t being wisely allocated or reinvested. On the other hand, if there are shortages every time, it could imply that the payment terms or price models aren’t operating as well as they could.

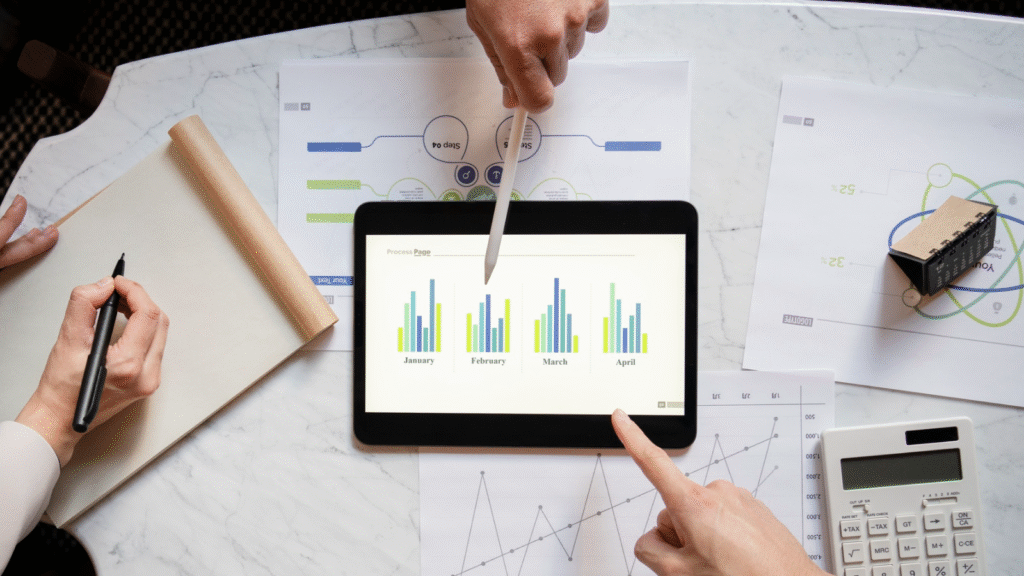

Using rolling 12-month graphs or simple bar charts to show cash flow trends might help you find seasonality, bottlenecks, and places that aren’t doing as well as they should. If you always have low net cash after a month with a lot of sales because your customers are late on their payments, you can make your collection process stronger.

Step 4: Examine Revenue Streams and Customer Segments

Not all revenue is the same. Some sorts of customers are more loyal than others, and some items or services make more money. A close look at revenue sources, by product line, service, or customer group, can provide useful trends.

When you do segment-level analysis, you typically find high-performing prospects that you didn’t think were important.

Assess each stream’s return using basic measures such as customer lifetime value or gross margin per product. This lets you make smart choices about how to change the services you provide or where to spend your marketing money.

You can make sure you’re expanding on your strengths instead of just working harder by linking this knowledge to your small business growth plan. Your financial data is your guide for doing more of what works.

Step 5: Analyze the Operational Costs and Overhead Expenses

To achieve sustainable growth, cost control is important. To see how each affects your profit margins, divide your operating costs into fixed and variable groups.

Look more closely at costs by department or process. Could some tasks be done automatically? Are you not using all of the features of a software subscription? Inefficient logistics, inadequate labor allocation, and vendor contracts are common areas where organizations find savings.

A basic list of common but often forgotten costs can help: software licensing, utility overcharges, underutilized office space, old subscriptions, or too many banking fees.

In order to support your small business growth goal without having to increase sales, make simple adjustments here to free up revenue for reinvestment.

Step 6: Ensure to Keep Track of Key Financial Ratios

Examine financial ratios that offer more in-depth information to advance your analysis. These are:

- The gross profit margin indicates how well you’re making what you sell.

- Operating margin lets you keep track of how profitable you are after paying for overhead.

- Return on investment (ROI) shows how well your investments are doing.

- Inventory turnover shows how quickly you’re selling your stock.

You may see trends by comparing these ratios over time, and you should also compare them to your industry whenever you can. A lower-than-average operating margin could mean that the business isn’t running as well as it could be, while a high inventory turnover could mean that the product is a good fit for the market.

Even if operational bloat is preventing you from growing your organization, some ratios can be used as early warning signs.

Step 7: Translate Insights Into Actionable Steps in Your Business Plan

Analysis without action is a waste of time. Converting financial findings into strategic decisions is the next stage. This may be redistributing your marketing budget, changing your pricing strategy, postponing your employment schedule, or making an investment in the creation of new products.

Your business plan or updated small business plan should include these decisions. This guarantees team alignment and gives you a benchmark for assessing your success.

Make it a practice to analyze your finances every three months. You may be proactive instead of reactive by making them a part of your normal business processes.

Remember that financial data is a tool for planning for the future as well as a record of the past.

Step 8: Set Up Feedback Loop

Lastly, build up a method to assess how well your changes are working. By monitoring post-action outcomes, you can lower risk and gradually enhance your strategies.

Based on what you learned, set simple, clear KPIs. A clear, quantifiable, and goal-aligned example might be “increase sales from high-margin services by 20% in six months.”

A feedback loop also helps you stay flexible. You’ll be able to change course early if anything doesn’t go as planned.

What changed with each review cycle? What did you find out? What should you put more effort into?

(Conclusion)

Financial data is the foundation for informed, prudent decision-making; it is more than just a compilation of documents. Small business owners may make sure their analysis is in line with a clear plan, organize vital small business data, and use it to direct their actions to achieve long-term success and growth.

You don’t need to become an expert in finance right away. Start small. Keep doing the same thing. Let what you learn guide you. When you start the business plan or refine an existing one, keep in mind that the most astute small business owners are aware of their numbers and use them to guide their decisions with confidence and clarity.